Let me guess—you’re running your childcare business and thinking, “Can’t I just handle my own books and taxes? After all, TurboTax makes it look so easy, and I’ve got QuickBooks already. Why should I pay someone else to do this?”

I hear you. If you’ve got a rock-solid understanding of accounting principles, know the ins and outs of childcare-specific tax deductions, and have plenty of time to stay on top of ever-changing tax laws, then maybe you can DIY your finances.

But here’s the thing, my friends. For most childcare business owners I work with, trying to be your own accountant is a bit like trying to be your own dentist. Sure, you can brush and floss daily, but eventually, you’re going to need someone who really knows what they’re doing to take a closer look.

Ready to work with a team that guarantees its commitment to your childcare business’s financial success? Let’s connect!

The Complexity of Childcare Business Finances

Childcare business finances aren’t as straightforward as many other industries. You’re juggling multiple revenue streams, dealing with complex regulations, and navigating a maze of potential tax deductions that most general accountants don’t even know about.

Consider all these variables that can impact your financial picture:

- Tuition tracking for different age groups and program types

- Grant funds with specific usage and reporting requirements

- Staff-to-child ratio requirements that affect your payroll costs

- Facility expenses with unique depreciation opportunities

- Food program reimbursements and proper documentation

- Business-use-of-home calculations for family childcare providers

- State-specific childcare subsidies and compliance requirements

It’s shocking how many childcare owners don’t even know where their money is coming from. They only look at the total number, not the breakdown of revenue streams.

But knowing exactly how much comes from private pay, state subsidies, food programs, or grants is essential for making smart business decisions.

You know what I see all too often? Childcare owners using generic accounting solutions that leave thousands of dollars in potential tax savings on the table.

That one-size-fits-all approach from a general accountant simply doesn’t cut it when it comes to maximizing your childcare center’s profitability.

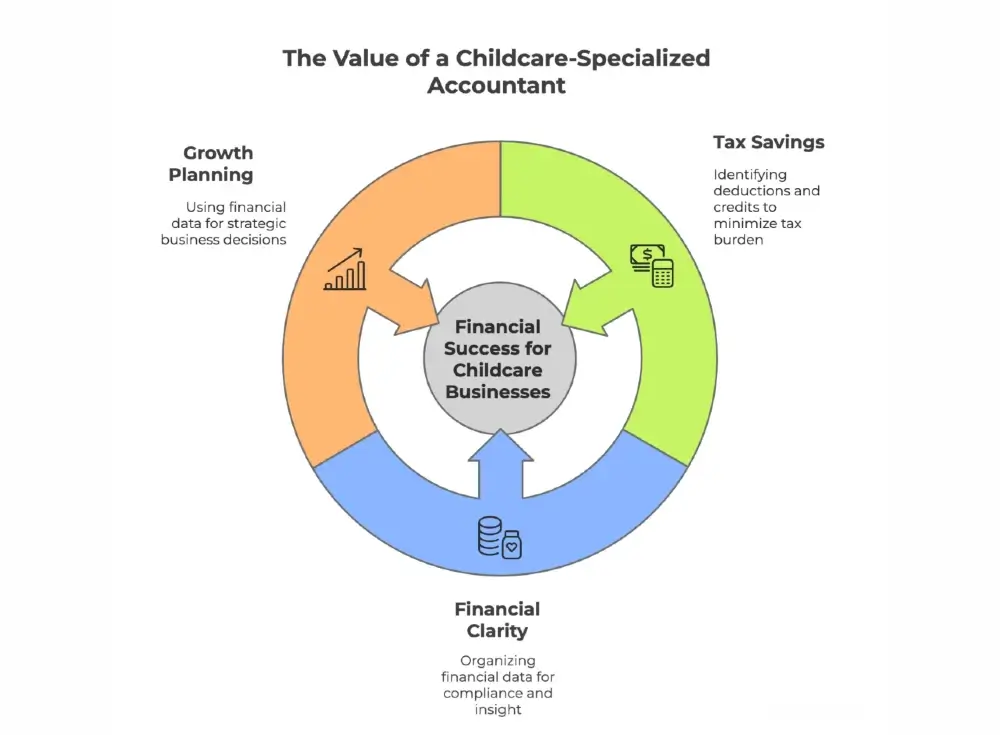

The Value of a Childcare-Specialized Accountant

When you work with an accountant who specializes in the childcare industry, you’re not just getting someone to crunch numbers. You’re partnering with a financial strategist who understands the unique challenges and opportunities in your business.

- Industry-Specific Tax Savings: A childcare-specialized accountant knows exactly which deductions and credits apply to your business. From playground equipment depreciation to staff training expenses, we know where to look to legally minimize your tax burden.

- Financial Clarity and Organization: We create systems specifically designed for childcare businesses, helping you track income, expenses, grants, and subsidies in a way that makes sense for your operations and ensures compliance.

- Strategic Growth Planning: Beyond just keeping you compliant, we help you utilize your financial data to make informed decisions about expansion, hiring, pricing, and program development that increase your profitability.

A Relatable Comparison

Think about it this way: When one of the children in your care needs special attention, do you implement a one-size-fits-all approach? Of course not! You understand their unique needs, challenges, and learning styles, and you adapt your care accordingly.

That’s exactly what a childcare-specialized accountant does for your business finances. We don’t just plug numbers into standard forms—we understand the nuances of your industry and create customized strategies that help your business thrive.

I want to tell you a quick story about a former consulting client of mine named Mr. Jerry, who opened a second location prematurely without analyzing the financials of his first center.

He had never fully monetized or reached full enrollment at his first location, yet he rushed into a high-rent strip mall with a five-year lease.

Sadly, he never achieved more than 70% enrollment, couldn’t make the lease payments, was eventually evicted, and his business ultimately filed for bankruptcy.

With proper financial guidance, Mr. Jerry could have avoided this outcome. He might have discovered that his existing location needed more marketing or operational improvements before expansion, or he could have negotiated a more favorable lease with terms better aligned with his actual financial position.

The Real Cost of DIY Accounting

I’ve seen it too many times—childcare owners who thought they were saving money by handling their own finances, only to discover they’ve been overpaying thousands in taxes each year.

Take my client, Jessica, for example. She was doing her own taxes for years. When she finally came to us for help, we identified several areas where she was missing out on significant tax savings.

For instance, we found that she could have reduced her payroll taxes by strategically handling her health insurance premiums. By reducing her salary by the amount of her health insurance premiums and including that in Box 1 of her W-2, she could have saved an additional $2,754 in payroll taxes.

Or consider this common scenario: A childcare owner purchases a new building for $500,000 and believes they can write off the entire amount in the first year.

When they discover this isn’t the case—commercial buildings must be depreciated over 39 years—they’re suddenly hit with a much higher tax bill than expected, with no cash left to pay it.

The truth is, when you hire a specialized childcare business accountant, what you’re really paying for isn’t just tax preparation—it’s peace of mind, strategic guidance, and expertise that can substantially impact your bottom line.

Stop Leaving Money on the Table: Partner with a Specialist

Can you manage your childcare business finances on your own? Possibly. But will you maximize your tax savings, maintain perfect compliance, and leverage your financial data to grow a more profitable business? That’s where having a specialized partner makes all the difference.

I’m not here to tell you that you absolutely must hire a childcare-specialized accountant. What I am saying is that your time is valuable, your business is complex, and the right financial partner can help you keep more of your hard-earned money while removing a significant burden from your shoulders.

During my webinars, I often tell childcare owners: “You must know your numbers to grow your numbers.”

Without clear financial visibility—knowing exactly which revenue streams are most profitable, which expenses are eating into your margins, and what your true financial position is—you’re essentially flying blind.

About the Author

Shanita Jones, known as The Childcare CPA™, helps childcare business owners gain financial clarity, reduce taxes, and build profitable businesses. Through her firm, Jones Taxes & Financial Services, LLC, she offers bookkeeping, tax strategy, and fractional CFO services specifically designed for the childcare industry.

Shanita is the author of “The Childcare CPA’s 7-Step Profit Multiplier: Slash Your Taxes and Accelerate Growth“ and has trained thousands of childcare providers through workshops, masterclasses, and speaking engagements.

Want to learn more about how we can help your childcare business thrive?

- Join Our Free Facebook Community!

Want exclusive financial tips, free training, and support from other childcare providers? Join our Facebook group, “Childcare Profit Strategies,” where we share expert strategies to help you save money and grow your business!