Let’s talk about something that can make or break your business’s financial health—choosing the right accountant. I know what you’re thinking: “Shanita, isn’t one accountant pretty much the same as another?” And trust me, that couldn’t be further from the truth, especially in the childcare industry.

The reality is that most childcare business owners overpay on taxes, struggle with messy bookkeeping, and miss out on valuable deductions simply because they don’t have the right financial professional in their corner.

In fact, nearly 60% of childcare businesses miss out on valuable tax deductions and credits, leaving thousands of dollars on the table every year.

I’ve worked with hundreds of childcare business owners who came to me after years of frustration with general accountants who didn’t understand their unique financial needs. So, I’m sharing my insider knowledge to help you make this crucial decision with confidence.

If you’re ready to work with a financial professional who truly understands the childcare industry, I’d love to help. Book a strategy call today to discover how we can help you gain financial clarity, reduce your taxes, and build a more profitable childcare business.

Industry Expertise Is Non-Negotiable When Choosing a Childcare Business Accountant

When it comes to finding the right accountant for your childcare business, not just any CPA will do. I’ve seen firsthand how most general accountants simply don’t understand the complexities of the childcare industry, from grant management to specific tax deductions.

Unlike other accountants or tax professionals, my team and I actually understand the childcare industry and the people who keep this economy running. This understanding makes all the difference in your financial outcomes.

Why Industry Expertise Matters

The childcare industry has unique financial considerations that general accountants often miss:

- The IRS has a specific audit guide for childcare businesses: Did you know the IRS has an audit technique guide specifically designed to train their agents on how to audit childcare businesses effectively? This demonstrates that even the IRS recognizes childcare as requiring specialized tax knowledge.

- Time-space ratio calculations are frequently miscalculated: I’m constantly seeing space percentages looking too low for family childcare business owners. If you’re using areas for storage, if you have exclusive areas and non-exclusive areas, don’t forget that even areas not used exclusively for childcare can count. An industry-specific accountant understands that preparation time, administrative work, and training hours all count toward your time-space percentage.

- Entity structure decisions have unique impacts: In some states, if your EIN changes, out goes your license and your quality star ratings, and you’ll be forced to start all over again. A general business attorney or accountant might not understand these childcare-specific consequences.

- Grant money has complex tax implications: Grant money is taxable when not properly structured. I’ve seen childcare business owners receive large grants and end up with shocking tax bills because their accountant didn’t help them plan properly.

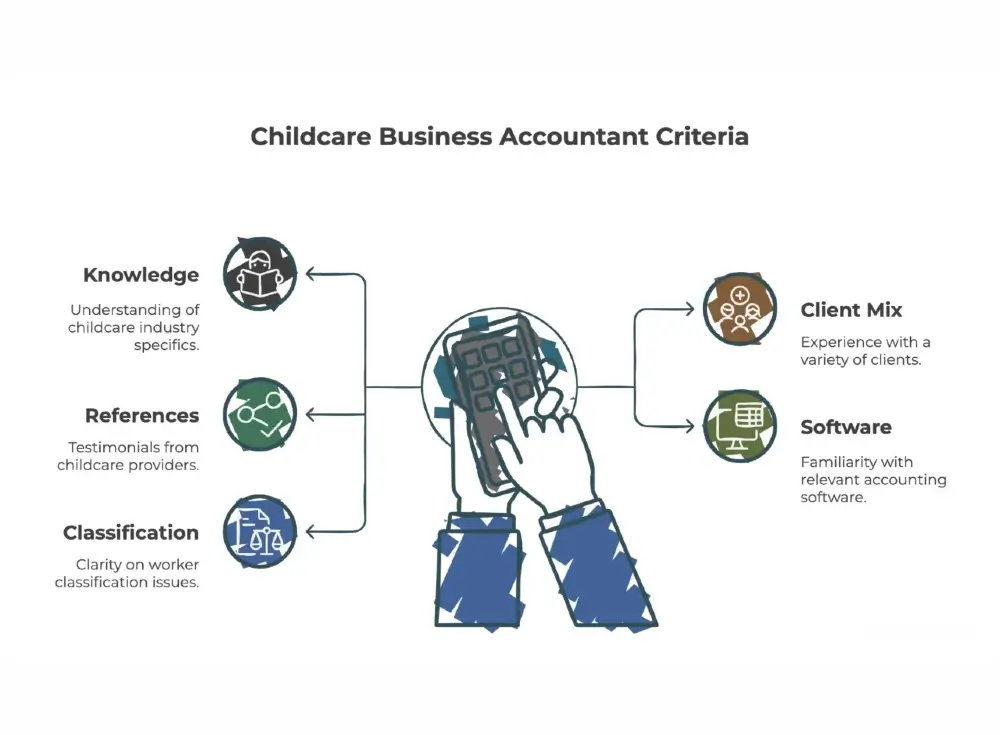

What to Look For in a Childcare Business Accountant

- Check for specialized knowledge and training: Beyond basic accounting credentials (like a CPA), look for professionals who demonstrate specific knowledge of childcare regulations and finances. The right accountant should be able to speak knowledgeably about things like subsidy requirements, food program documentation, and childcare-specific tax deductions without hesitation.

- Ask about their client mix: An accountant who serves multiple childcare business owners will have broader insights into industry benchmarks and best practices. They’ll know what’s “normal” for your business type and size, allowing them to spot unusual patterns or opportunities.

- Request childcare-specific references: Speaking with other childcare business owners who have worked with this accountant can give you valuable insights into how they handle industry-specific challenges.

- Verify they understand childcare software limitations: Most childcare management systems handle the operational pieces very well, but they are not made specifically for accounting and producing useful reports. Your accountant should know how to bridge this gap.

- Ensure they understand proper worker classification: With childcare workers, classification can be tricky. An industry expert will know that, generally speaking, childcare workers are employees because you control the nature of their work, when they work, how they work, and what they do.

Beyond Tax Season: Why You Need Year-Round Financial Support

Many childcare business owners make the mistake of thinking they only need an accountant during tax season. But the most valuable financial support happens long before your tax return is due.

- Financial clarity all year: Your accountant should provide monthly or quarterly financial reports that help you understand your business’s health at a glance. This allows you to make informed decisions about staffing, enrollment, and pricing throughout the year.

- Proactive tax planning: The best tax strategies are implemented well before December 31st. A good accountant will work with you throughout the year to minimize your tax burden legally, not just prepare your return once the year is over.

- Grant tracking and compliance: Many childcare centers receive various grants and subsidies that require specific financial tracking and reporting. Your accountant should help you maintain compliant records to ensure you remain eligible for these crucial funding sources.

- Cash flow management: Childcare businesses often struggle with seasonal enrollment fluctuations and consistent cash flow. Look for an accountant who can help you budget effectively and develop strategies to smooth out these financial variations.

- Growth planning support: As your business expands, you’ll need guidance on structuring new locations, managing increased payroll, and optimizing your tax situation. An accountant with experience helping childcare businesses scale can be invaluable.

The Red Flags That Say "Run" When Interviewing Accountants for Your Childcare Business

Not all accountants are created equal, and some warning signs should send you running in the opposite direction.

- They don’t ask about your business goals: If an accountant only wants to talk about numbers and never asks about your vision for your childcare business, they’re not going to be a strategic partner in your growth.

- They can’t explain childcare-specific deductions: Ask them about home office deductions for childcare business owners or how grant income is reported. If they seem confused or give vague answers, they likely don’t have the specialized knowledge you need.

- They’re only available during tax season: Your financial health requires year-round attention. An accountant who disappears after April 15th isn’t going to help you build a profitable, sustainable business.

- They promise unusually large refunds without reviewing your documents: Be wary of accountants who make big promises without analyzing your specific situation. Ethical accountants will only promise what they can realistically deliver.

- They don’t explain their pricing clearly: Financial transparency should start with your accountant’s own billing practices. If they can’t clearly explain their fee structure, it’s a red flag for how they’ll handle your finances.

The Value Question: Why Finding the Right Accountant Is About More Than Just the Fee

When choosing an accountant, it’s important to look beyond just the fee structure and consider the total value they bring to your business.

- Missed deductions add up: A childcare-specialized accountant can help identify tax deductions and credits that a general accountant would miss. I’ve personally helped clients save thousands of dollars that more than covered my fee from their previous accountant.

- Audit protection is priceless: Proper documentation and compliance significantly reduce your audit risk. And if you are audited, having an experienced professional who knows your industry can make the difference between a routine procedure and a costly nightmare.

- Strategic guidance creates growth: The right accountant doesn’t just record what happened yesterday; they help you plan for tomorrow. This forward-thinking approach can dramatically improve your profitability over time.

- Time is money: When you work with a specialized accountant who understands your business, you spend less time explaining childcare-specific issues and more time focusing on providing quality care to the children in your program.

- Peace of mind is invaluable: Knowing that your finances are in the hands of someone who truly understands your industry allows you to sleep better at night and focus on what you do best—caring for children and building your business.

The Bottom Line: Choose an Accountant Who Understands Your World

The financial complexities of running a childcare business are unique, and you deserve an accountant who specializes in navigating them. Don’t settle for a general CPA who treats your childcare center like any other small business.

By choosing an accountant with childcare-specific expertise, you’re not just hiring someone to crunch numbers—you’re investing in a strategic partner who can help you build a more profitable, sustainable, and stress-free business.

Remember, Childcare CEOs, you’re already doing the important work of caring for our next generation. Make sure you have the right financial support to keep your business thriving for years to come.

Ready to experience what working with a childcare-specialized accountant is really like? My team and I have helped hundreds of childcare business owners save thousands in taxes, gain complete financial clarity, and build thriving businesses that stand the test of time.

- Join Our Free Facebook Community!

Want exclusive financial tips, free training, and support from other childcare providers? Join our Facebook group, “Childcare Profit Strategies,” where we share expert strategies to help you save money and grow your business!