Running a childcare business is a labor of love, but when it comes to finances? That’s where things can get messy.

Taxes, payroll, grants, compliance—it’s enough to make your head spin. And if you’re not working with an accountant who truly understands the childcare industry, you could be leaving tens of thousands of dollars on the table.

I see it all the time: childcare businesses unknowingly overpay $20,000 to $30,000 in taxes—simply because they don’t have the right financial expert in their corner.

The good news? You don’t have to be one of them.

Hiring the right accountant isn’t just about finding someone who can crunch numbers but choosing a strategic financial partner who can maximize your tax savings, keep you compliant, and set your business up for long-term success. But not all accountants are created equal.

Here are 10 must-ask questions to ensure you hire the right childcare accountant.

Want expert help now?

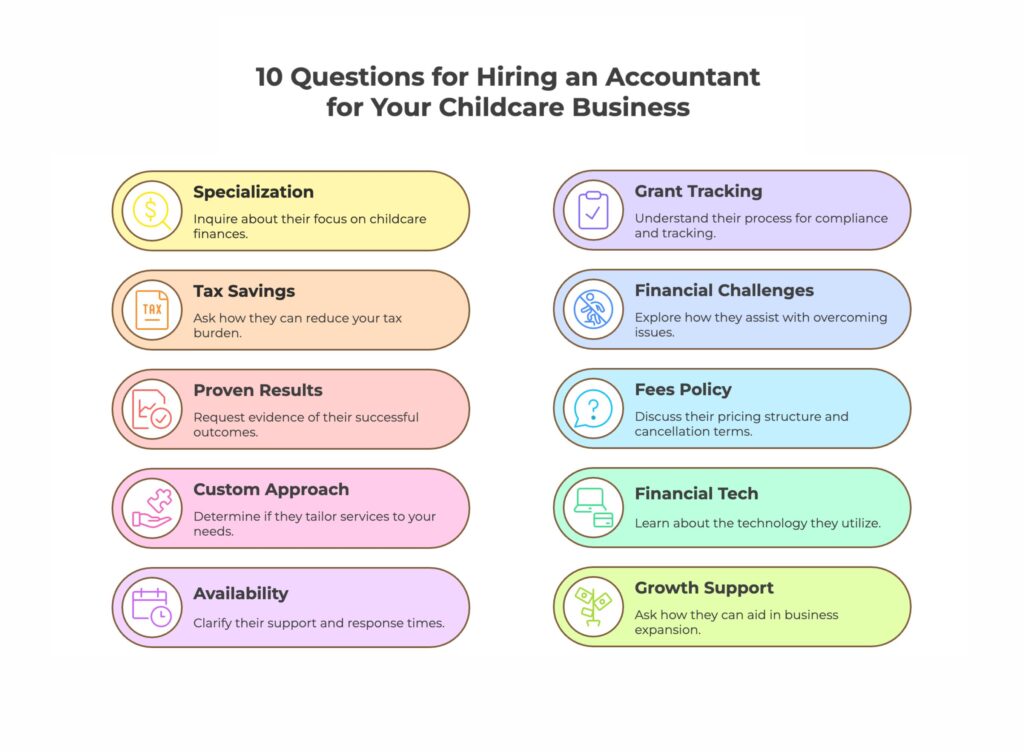

1. Do you specialize in childcare finances?

Just because someone has “CPA” after their name doesn’t mean they know the first thing about childcare finances. You wouldn’t let just anyone run your classrooms—so why let just any accountant handle your money?

Look for an accountant who:

- Has experience working with childcare providers

- Understands childcare-specific tax deductions, credits, and grant funding

- Knows the compliance requirements for federal programs like CCDF and Head Start

Your accountant should be able to explain how they keep up with changing tax laws and childcare-specific financial requirements. If they can’t answer industry-specific questions on the spot, keep looking.

2. How can you save me money on taxes?

A great accountant isn’t just there to file your taxes—they’re there to slash your tax bill before you ever owe a dime.

If your accountant isn’t talking to you about tax planning, you’re paying more than you should

A strategic childcare accountant will help you:

- Reduce self-employment taxes with smart business structuring

- Identify overlooked deductions (many providers miss thousands in write-offs!)

- Use depreciation strategies to maximize savings

- Plan for expansion without creating a tax nightmare

For example, I recently helped a childcare center owner named Maria restructure her business from a sole proprietorship to an S-Corporation, saving her over $29,722 in taxes the first year alone.

3. Do you have proof you can deliver results?

Would you trust a new teacher without a background check? Then why trust an accountant without proof they can save you money?

A proven track record is key when hiring a childcare accountant. Ask for testimonials, case studies, or references specifically from other childcare providers who have faced similar challenges to yours.

Let me share a few clients we’ve helped:

Michael came to us paying $18,000 in unnecessary self-employment taxes. By implementing the right tax strategies, we reduced his tax bill from $30,000 to $6,000—an 80% savings.

We’ve helped other childcare owners implement our Self-Rentals strategy, where the investor purchased the building and leased it to the childcare center.

This structure allows businesses to have a high-quality facility while creating significant tax advantages through the rental relationship. The approach generates rental income for the investor while providing legitimate business deductions for the childcare operation, creating a win-win financial situation.

Look for an accountant who can provide specific examples of how they’ve helped childcare businesses like yours overcome financial challenges and achieve their growth goals.

4. Do you customize your approach for each business?

Every childcare business is unique, and in my experience, a one-size-fits-all approach simply doesn’t work.

The financial needs of a single-location family childcare provider will differ significantly from those of a multi-center operation.

Look for an accountant who customizes their services based on:

- Your revenue size & funding sources

- Tuition, grants, and government reimbursements

- Your long-term business goals

- Whether you lease, own, or plan to purchase your facility

Your accountant should take the time to understand not just your numbers, but your vision for your childcare business. This deeper understanding helps create financial strategies that truly support your goals.

5. What is your availability and support system?

Financial problems don’t wait for tax season. When you have a grant deadline or a cash flow issue, you need answers fast.

You need an accountant who provides consistent, reliable support throughout the year.

In my practice, I ensure clients receive:

- Response to financial questions within 2-3 business days

- Regular financial check-ins and advisory meetings

- Priority support during critical periods like tax season and grant deadlines

- Access to a skilled team of financial experts, not just one person

- Monthly financial reports delivered by the 15th of each month

Having access to expert guidance when you need it can make all the difference in keeping your business financially secure and avoiding costly mistakes.

6. How do you handle grant tracking and compliance?

Let me tell you something real: Grant mismanagement isn’t just a paperwork problem—it’s a financial disaster waiting to happen. I’ve seen childcare businesses lose their entire quality star ratings and funding just because they didn’t understand the nitty-gritty of grant compliance.

If your accountant isn’t tracking your grants properly, you could end up paying money back or—worse—losing future funding opportunities. And in this industry, every dollar counts.

Your accountant should:

- Track state and federal grants separately (and I mean SEPARATELY—no mixing funds!)

- Ensure correct expense categorization that meets specific grant requirements

- Keep audit-ready documentation so you’re never caught with your financial pants down

Pro tip from someone who’s seen it all: The IRS actually has a specific audit technique guide just for childcare businesses. That means they’re paying extra attention to how you manage your money. One wrong move, and you could be forced to start all over again—just like my client, Mrs. X, who lost her nonprofit status because she didn’t understand the compliance details.

When you’re interviewing potential accountants, don’t just ask if they can track grants. Ask how they’ll help you grow your numbers while keeping you compliant and confident.

7. How do you help childcare businesses overcome financial challenges?

Your accountant should be more than a number cruncher—they need to be a financial first responder for your business.

Let me give you a real-world example: I once worked with Khadijah, a childcare center owner bringing in $2.5 million annually, who was unknowingly leaving $200,000 in uncaptured expenses on the table and overpaying $74,000 in taxes.

That’s money that could have been reinvested in your center, your staff, or your own future.

When you’re looking for an accountant, you need someone who can spot these financial landmines before they blow up your business. Look for professionals who can:

- Diagnose Hidden Financial Issues: Beyond basic bookkeeping, they should identify missed opportunities and potential savings

- Develop Strategic Solutions: Offer concrete strategies to improve cash flow, optimize pricing, and reduce unnecessary expenses

- Provide Childcare-Specific Insights: Understand the unique financial challenges of running a childcare business

Ask potential accountants for specific examples of how they’ve helped other providers overcome financial challenges. The right accountant doesn’t just prepare your taxes—they prepare your business for long-term success.

8. What are your fees and cancellation policy?

Surprise invoices? No thanks.

Understanding the cost of accounting services upfront prevents surprises and helps you budget appropriately. Having worked with childcare providers of all sizes, I know how important predictable expenses are for business planning.

Be sure to clarify:

- Fee structure (monthly retainer, hourly rate, or flat fees)

- What services are included in the base fee

- Additional charges for extra services like audit support or special projects

- Payment terms and frequency

- Cancellation policies and notice requirements

- Whether tax preparation is included or billed separately

A professional childcare accountant will be completely transparent about their pricing and clearly explain the value they provide. They should also be willing to discuss payment plans or service packages that fit your budget while meeting your business needs.

9. What financial tech do you use?

Outdated systems = wasted time and money.

Having the right financial technology can make or break your business efficiency. Your childcare accountant should be using modern tools that:

- Integrate with common childcare management software

- Provide secure, real-time access to your financial data

- Automate routine bookkeeping tasks

- Generate easy-to-understand financial reports

- Ensure data security and backup

Ask about their experience with systems like QuickBooks, Brightwheel, or other childcare-specific platforms. The right technology partnership can save you time and provide better financial insights.

10. Can you help me grow and expand?

A forward-thinking accountant should help you plan for the future, not just survive tax season.

Here are a few ways your accountant can support your business growth:

- Evaluate the financial feasibility of expansion opportunities

- Structure financing for new locations or facility purchases

- Create financial projections for bank loans or investors

- Plan for hiring and managing larger staff teams

- Scale your financial systems as you grow

At The Childcare CPA™, we emphasize the importance of detailed financial planning before expansion. In Chapter 7 of my book, “The Childcare CPA’s 7-Step Profit Multiplier,” I explain how proper growth planning includes evaluating expansion opportunities, structuring financing for new locations, and creating financial projections to ensure your business is positioned for sustainable growth.

Take Control of Your Childcare Business Finances Today

Hiring the right childcare accountant isn’t just about tax filing—it’s about having a financial partner who helps you maximize savings, stay compliant, and grow your business with confidence. The right accountant can be the difference between struggling with financial uncertainties and building a thriving, profitable childcare business.

Through my 15+ years of working with childcare providers, I’ve seen how proper financial guidance can transform a business. From saving thousands in taxes to securing funding for expansion, the impact of having the right financial expert on your team is invaluable.

Remember, your childcare business deserves an accountant who:

- Understands the unique challenges of the childcare industry

- Provides proactive financial strategies, not just reactive solutions

- Helps you build long-term financial success

- Has a proven track record of helping childcare providers grow

Ready to Stop Overpaying Taxes & Start Growing Your Business?

Let’s create a financial strategy tailored to your childcare business. Book a free consultation today and discover how we can help you achieve your financial goals!

- Join Our Free Facebook Community!

Want exclusive financial tips, free training, and support from other childcare providers? Join our Facebook group, “Childcare Profit Strategies,” where we share expert strategies to help you save money and grow your business!