Are you feeling overwhelmed trying to manage both quality childcare and your business finances? You’re not alone.

One of the most impactful decisions you’ll make as a childcare owner is choosing the right accountant—someone who truly understands the unique challenges of our industry.

Running a childcare business is demanding enough without the added stress of managing your finances, bookkeeping, and tax obligations. Many of you are so focused on delivering quality care that financial matters take a backseat, often leading to missed deductions, compliance issues, and unnecessary tax burdens.

I’ve seen far too many childcare owners leave thousands of dollars on the table simply because they’re working with accountants who don’t understand the unique aspects of our industry.

So today, I want to share the eight key things you should look for when choosing an accountant for your childcare or daycare business.

Ready to partner with a childcare business accountant who understands your unique needs? Let’s chat!

1. Industry-Specific Knowledge

Accountants who don’t specialize in the childcare industry might miss childcare-specific deductions and credits because they simply don’t know what to look for.

For example, did you know that the IRS has an audit technique guide specifically designed to train its agents on how to effectively audit childcare businesses?

A childcare-focused accountant will understand financial aspects unique to the childcare industry, such as reimbursement programs, subsidy payments, grant tracking, and the specific tax regulations that apply to all childcare operations.

This understanding ensures that you don’t miss childcare-specific deductions and credits and helps structure your finances to withstand scrutiny.

2. Comprehensive Financial Services Beyond Tax Preparation

Look for an accountant who offers more than just tax preparation. Many childcare owners come to me after overpaying thousands in taxes simply because their previous accountant only saw them once a year during tax season.

A good childcare accountant provides bookkeeping, financial organization, business structure optimization, and proactive tax planning throughout the year.

They should be able to help you track your income and expenses accurately, reconcile your accounts, and provide regular financial reports so you can make informed decisions about your business.

3. Proactive Tax Planning and Strategy

A quality childcare accountant doesn’t just react to your financial data. They help you plan to minimize your tax burden legally. This means regular check-ins, quarterly tax estimates, and strategic advice on timing major purchases or investments.

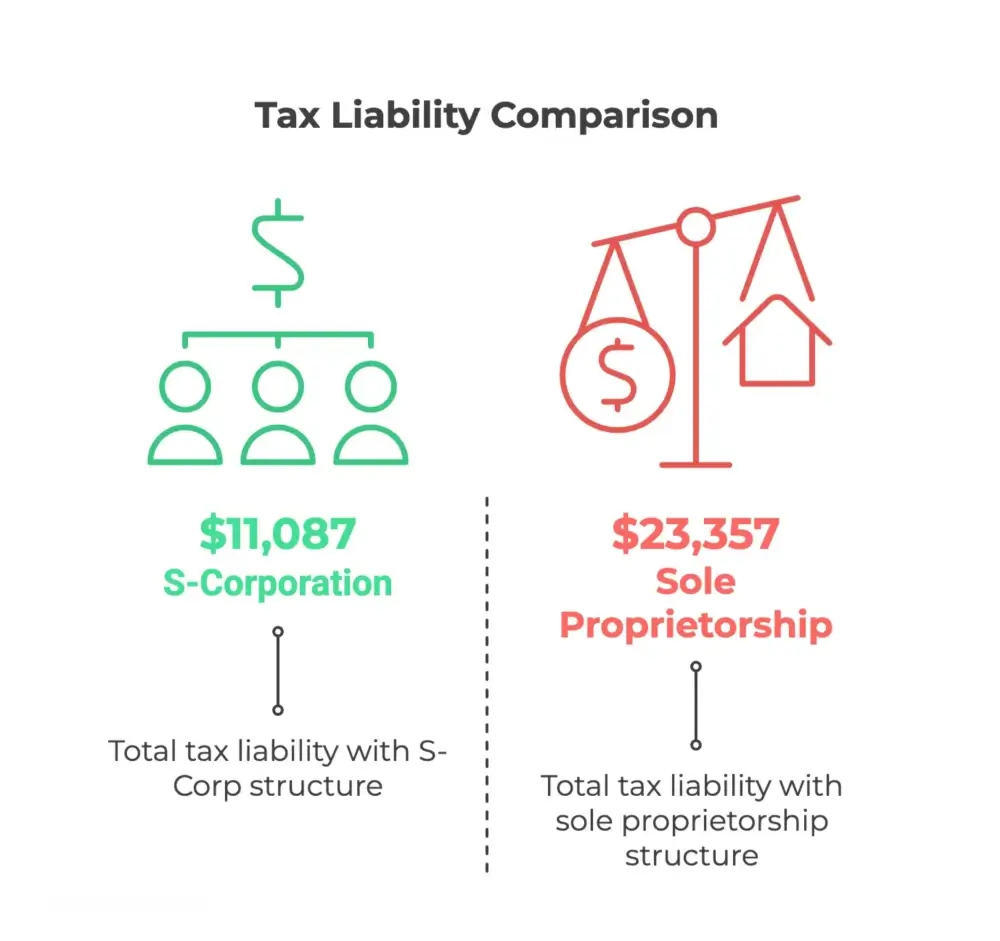

Case Study: Switching to S-Corporation at the Right Time

Jessica learned the hard way. When she first started her childcare business, she set it up as a sole proprietorship because it was the easiest option.

But as her business grew, she never revisited her entity choice. She was still filing Schedule C and paying self-employment tax on her entire net income.

To make matters worse, Jessica was using a DBA (doing business as) name, so even if she wanted to make the late election to be taxed as an S-Corporation, she couldn’t start reaping the benefits of that choice retroactively.

If Jessica had instead structured her business as an LLC, she could have made an election to be taxed as an S-Corporation when the time was right. With the S-Corporation, Jessica could have paid herself a reasonable salary (which would be subject to that self-employment tax) and then taken the remaining profits as distributions, which aren’t subject to the 15.3% tax. That simple change could have saved her thousands of dollars per year!

Let’s break down Jessica’s numbers. She had a net business income of $56,900 after her $40,000 officer compensation (which takes into consideration the $3,060 of deductible employer payroll taxes).

This provides a significant opportunity for tax optimization through the S-Corporation structure. Here is a table comparing her tax liability.

|

Entity Type |

Income Tax |

Self-Employment Tax |

Total Tax |

|

Sole Proprietorship |

$9,228 |

$14,129 |

$23,357 |

|

S-Corporation |

$11,087 |

$0 |

$11,087 |

|

Tax Savings with S-Corp |

$12,270 |

– |

$12,270 |

4. Clear Financial Reporting and Education

Your accountant should provide easy-to-understand financial reports and take time to educate you about what those numbers mean for your business.

In my experience, many childcare owners avoid looking at financial reports because they don’t understand them, which is a recipe for disaster.

Look for an accountant who provides profit and loss statements, balance sheets, and cash flow projections in a format you can understand. They should be willing to walk you through these reports and explain how you can use them to grow your business. I always say, “You must know your numbers to grow your numbers.”

5. Understanding of Grant Compliance and Funding Requirements

With the prevalence of grants in the childcare industry, your accountant should understand how to properly track and report on grant funds. Many providers have been forced to repay grants or become ineligible for future disbursements because they improperly tracked their funds.

A specialized childcare accountant will help you set up systems to ensure you remain compliant with grant requirements and can produce the necessary documentation when needed.

They should also understand how grants impact your tax situation, because yes, most grants are taxable income unless specifically stated otherwise.

6. Transparent and Responsive Communication

Your financial professional should communicate clearly about their processes, fees, and timelines.

Many childcare providers I’ve worked with share stories of accountants who are impossible to reach outside of tax season or who use technical jargon without explaining what it means.

Choose an accountant who responds promptly to your questions, explains complex concepts in terms you can understand, and is proactive about reaching out when there are changes to tax laws or regulations that might affect your business. Financial clarity requires communication clarity.

7. Business Growth and Profitability Support

A great childcare accountant should help you think strategically about your business growth, not just manage your taxes. They should help you answer questions like: Is your tuition structure profitable? Should you expand to a new location? How can you improve your cash flow?

Case Study: Optimizing Before Expanding

David was eager to open his third childcare facility, but his first two locations were only operating at around 70% capacity.

When we sat down to crunch the numbers, it became clear that David was leaving a significant amount of money on the table by not maximizing the enrollment and profitability of his existing centers.

So instead of rushing into expansion, we worked with David to implement a series of targeted initiatives, things like revamping his marketing and enrollment strategies, optimizing his staffing and scheduling, and finding new revenue streams like summer camps and after-school programs.

Within just 12 months, David had boosted the occupancy rates of his first two centers to 90%, and his profit margins had increased by over 25%.

8. Financial Education and Empowerment

The best childcare accountants don’t just do the work for you—they teach you how to become financially savvy in your business. Look for an accountant who offers training, resources, and tools to help you understand your business finances better.

Financial literacy isn’t just about knowing where your money goes; it’s about understanding how to use that information to make better business decisions.

When you’re financially empowered, you can build a more sustainable, profitable childcare business that serves your community for years to come.

The Bottom Line: Your Childcare Business Deserves Specialized Financial Support

Remember, the right childcare business accountant doesn’t just save you money at tax time (though that’s certainly important!). They become a trusted partner in your journey, helping you make strategic decisions, navigate complex regulations, and build a childcare business that’s not just surviving but truly thriving.

By choosing an accountant with industry-specific knowledge, proactive tax planning skills, and a genuine commitment to your success, you’re making an investment that will pay dividends for years to come. You’re not just hiring someone to crunch numbers—you’re bringing on a key player in your business growth strategy.

At The Childcare CPA™, my team and I understand the unique challenges you face because childcare is all we do. We’d love to show you how the right financial guidance can transform your childcare business from stressful to strategic.

Ready to take control of your childcare business finances?

Schedule your free strategy call to learn more about how we can help you pay less in taxes, get financially organized, and grow a more profitable childcare business.

- Join Our Free Facebook Community!

Want exclusive financial tips, free training, and support from other childcare providers? Join our Facebook group, “Childcare Profit Strategies,” where we share expert strategies to help you save money and grow your business!