If you’ve landed on this article, you’re likely at a crossroads with your childcare center’s finances. Maybe you’re tired of scrambling at tax time, sick of missing deductions, or just plain exhausted from trying to handle it all yourself.

So what’s the real difference between working with a specialized childcare accountant versus a general accountant or trying to DIY your finances?

How do you choose the right financial partner to help your childcare business thrive?

I’m here to help you understand why partnering with a specialized childcare accountant might be the game-changer your business needs.

Stop letting generic accountants miss your childcare-specific deductions! Schedule a free consultation to see how a specialized firm can transform your finances.

1. We Understand the Unique Financial Challenges of Childcare Businesses

Let’s be real—most accountants don’t have a clue about the complexities of running a childcare center. They’re treating your business like any other, missing industry-specific deductions and opportunities.

Take the case of one of our clients, Tom, who ran a small daycare center. When he first opened, he didn’t have much money in his business account, so he signed up to pay utilities from his personal account.

After two years, he discovered that the cable, phone, and internet for the center were still attached to his personal bill, costing him $350 per month or $4,200 per year in missed tax deductions. At a 32% tax bracket, this meant Tom overpaid $1,344 in taxes annually.

While these utilities aren’t childcare-specific deductions, being too busy to ensure they come from the business account is a common mistake we see childcare owners make. Because we exclusively serve childcare providers, we catch these missed opportunities others might overlook.

When you work with me and my team, you’re not just getting an accountant—you’re getting a financial partner who speaks your language.

2. We Help You Keep More of Your Hard-Earned Money

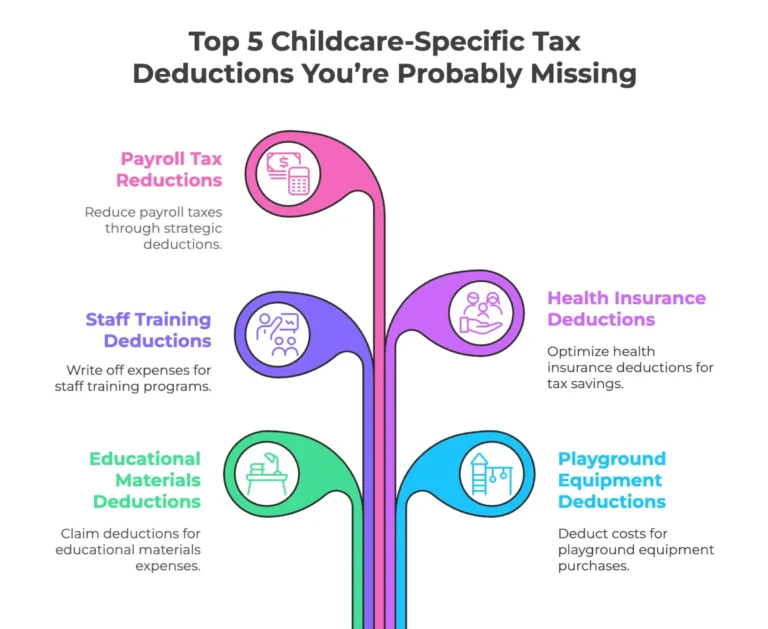

Many childcare owners are overpaying thousands in taxes simply because they don’t know which expenses they can legally write off.

I’ve seen providers missing out on deductions for educational materials, playground equipment, staff training, and so many other legitimate business expenses.

Consider Jessica’s experience with health insurance deductions. She was paying $3,000 per month ($36,000 annually) for health insurance for herself, her husband, and their three children.

Jessica was doing her own taxes and incorrectly placed her medical premiums on Schedule A for itemized deductions. Since her total itemized expenses didn’t exceed the standard deduction, she received no tax benefit from this substantial expense.

When Jessica started working with our firm, we found this oversight and made the proper adjustments. By adding the $36,000 to box 1 of her W-2 and taking the Self-Employed Health Insurance deduction, plus reducing her payroll taxes by $2,754, we saved her over $14,000 in taxes.

This was just one oversight that could have funded both her and her husband’s Roth IRA accounts for the year!

With our childcare-specific expertise, we ensure you claim every eligible deduction and credit while remaining fully compliant with IRS regulations.

3. We Provide Year-Round Support, Not Just Tax Season Band-Aids

Too many accountants only pop up during tax season, leaving you to figure everything out on your own the rest of the year. That approach leads to surprising tax bills, missed opportunities, and financial stress.

James learned this lesson the hard way when he was slapped with a massive $15,000 payroll penalty because he was a little late on submitting his quarterly 941 forms. This completely avoidable situation could have been prevented with proper guidance and support throughout the year, not just at tax time.

Our approach is different. We offer year-round support through our Monthly Accounting & Tax Advisory Package, providing ongoing financial management, tax strategy, and profitability tracking. This means you’re never scrambling to gather paperwork at the last minute or wondering if you’re on track financially.

4. We Turn Financial Chaos into Clarity

I’ve seen the shoe boxes of receipts. The Excel spreadsheets with missing data. The panic when grant reporting is due or when a loan application requires financial statements.

Take Chavette, who had been using a basic spreadsheet workbook to manage her finances. When she received a large, unexpected tax bill, she realized her spreadsheet method didn’t allow for accurate tax estimations throughout the year.

Additionally, as she considered purchasing her own building, she discovered she couldn’t easily track cash flow or project when she’d have the necessary funds available. Without a proper cloud-based accounting system, she struggled to identify patterns and trends to predict future financial needs.

We transform that chaos into clarity with proper bookkeeping, organized financial systems, and clear monthly reports. Our clients receive monthly profit and loss statements, balance sheets, and quarterly budget reviews so they always know exactly where their business stands financially.

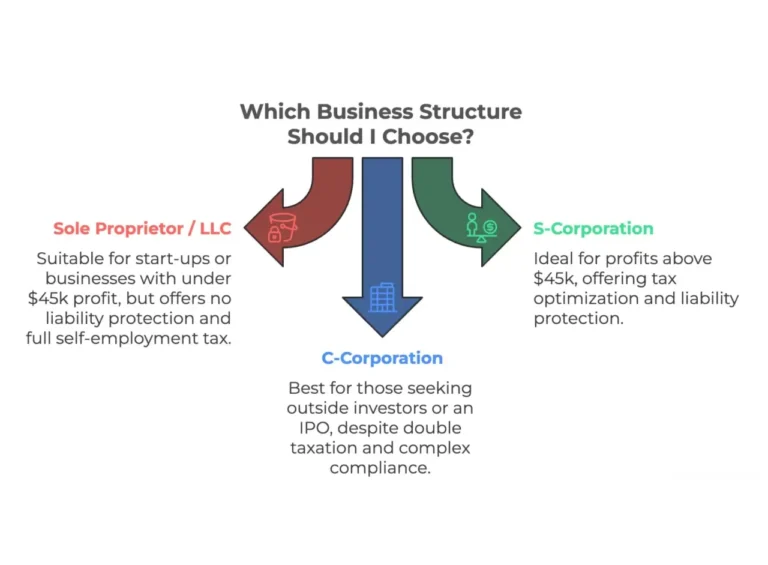

5. We Help You Structure Your Business for Maximum Tax Savings

The structure of your business isn’t just a technicality—it’s the blueprint that shapes your entire financial future. Yet many childcare owners choose the wrong entity or never revisit that decision as their business grows.

Michael’s story illustrates this perfectly. He had always believed that tax planning was only necessary for large businesses and took pride in owing taxes to the IRS (his former accountant told him this was a sign of profitability).

When Michael came to us, we discovered that of the $36,000 he owed, $18,000 was needlessly being paid in self-employment taxes!

We performed an entity optimization for Michael, converting his business to an S-Corporation. We also discovered that he primarily worked from home and spent more time working on the business at home than at his center.

By implementing an accountable plan, we reduced his tax bill from $30,000 to $6,000—an 80% savings. Had Michael found us earlier in the year, we could have implemented strategies to reduce his bill to zero.

We work closely with our clients to ensure they’re using the right business structure at the right time, maximizing tax benefits as their childcare business grows.

6. We Help You Plan for Growth and Profitability

Running a childcare center isn’t just about surviving—it’s about thriving. Whether you want to open additional locations, increase your enrollment, or simply increase your profit margins, you need a financial strategy that supports your goals.

Consider Tamika, who owned five childcare locations all within a five-minute drive of each other. Before working with us, she had no clear understanding of the profitability of each location, only knowing that her business was profitable overall.

She assumed her first center—her pride and joy—was the most profitable due to its size and enrollment numbers

After segregating Tamika’s financial statements by location, we discovered that her first location was actually draining resources from the other profitable centers!

This clarity allowed Tamika to make informed decisions, reassign families and staff from the two non-profitable locations, and repurpose the space for other business ventures she had in mind.

Our Fractional CFO services help childcare CEOs develop scalable pricing models, create financial forecasts, and implement proactive tax planning. We’re not just looking at where your business is today, but helping you chart a course for where you want to be tomorrow.

7. We're More Than Just Number-Crunchers

When you partner with The Childcare CPA™, you’re getting a dedicated team that understands that behind those numbers are real people making a difference in children’s lives.

Take Ms. Lauren, who has been running her childcare business for 27 years. Her center was a true staple in the community, with graduates who went on to become teachers, lawyers, doctors, and even a mayor.

But when Ms. Lauren was ready to retire, she only had her personal savings to rely on. She had always put off retirement planning, thinking she’d get around to it “someday,” when she had more money.

That day never came, and at 69 years old, she was forced to keep reporting to work every day because it was her only source of income.

We were able to help Ms. Lauren transition from being an Owner-Director to a Founder-CEO. This meant her business could continue paying her even after she stepped back, and she was able to make investments that would allow her to eventually sell the business to a trusted long-time employee.

We believe that financially stable childcare businesses create stronger communities. By helping you optimize your finances, we’re supporting your mission to provide high-quality care and education to the children and families you serve.

Your Bottom Line Deserves a Specialist, Not a Generalist

Let me ask you this: If your child needed specialized medical care, would you take them to a general practitioner or a specialist who focuses exclusively on their specific condition?

The answer is obvious, right? You’d choose the specialist every time.

Your childcare business deserves that same level of specialized care when it comes to your finances.

The difference between working with a general accountant and a childcare-specific financial partner isn’t just about tax forms—it’s about having someone in your corner who truly understands your unique challenges, opportunities, and goals.

Just like childcare isn’t “just babysitting,” childcare accounting isn’t “just bookkeeping.” The nuances of your industry require specialized knowledge that most general accountants simply don’t have.

At The Childcare CPA™, we’ve helped hundreds of providers just like you transform financial chaos into clarity, slash their tax bills, and build truly profitable childcare businesses.

Isn’t it time your childcare center’s finances got the specialized attention they deserve?

Book a strategy call with our team today, and let’s talk about how we can transform your financial future.

- Join Our Free Facebook Community!

Want exclusive financial tips, free training, and support from other childcare providers? Join our Facebook group, “Childcare Profit Strategies,” where we share expert strategies to help you save money and grow your business!