Let’s be real. Most of you didn’t open your centers because you were passionate about tracking expenses, reconciling bank accounts, or managing financial statements.

You started your business because you care deeply about children and want to make a difference in their lives and your community.

Yet here you are, burning the midnight oil trying to make sense of your QuickBooks account, wondering if you’ve categorized everything correctly, and worrying whether you’re missing tax deductions specific to the childcare industry. Sound familiar?

The question I get all the time is: “Shanita, when should I stop doing my own bookkeeping and hire someone to do it for me?” It’s a great question and one that deserves a thoughtful answer.

After all, every dollar you spend on professional services needs to deliver a solid return on investment for your childcare business.

Stop letting DIY bookkeeping drain your time and money! Schedule a free consultation to see if outsourcing is right for your childcare business.

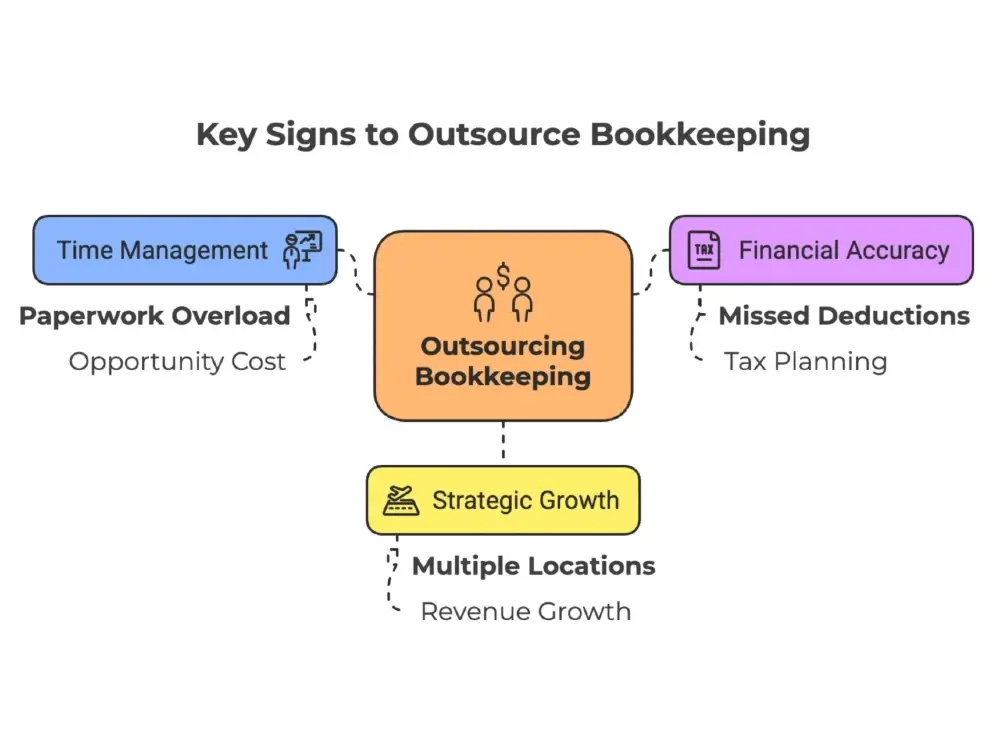

Key Signs It's Time to Outsource Your Bookkeeping

As The Childcare CPA™, I’ve worked with hundreds of providers at various stages of business growth, and I’ve identified clear signals that it’s time to bring in a financial specialist. Let’s explore the three major scenarios where outsourcing makes absolute sense:

1. You're Spending Valuable Time on Books Instead of Business Growth

If you find yourself locked in your office doing paperwork instead of engaging with children, parents, or staff, that’s a significant problem.

Your highest value as a childcare CEO comes from your leadership, curriculum development, parent relationships, and team building—not from manually entering receipts.

Many providers tell me they spend 10-15 hours each week on bookkeeping tasks. That’s essentially two full workdays! At a conservative value of $50/hour for your time as a business owner, that’s $26,000 per year in opportunity cost.

Every hour spent wrestling with spreadsheets or reconciling bank statements is an hour you’re not investing in:

- Developing new programs that could increase your revenue

- Mentoring your staff to improve quality and retention

- Meeting with parents to strengthen relationships

- Networking and marketing to fill empty spots

- Taking care of yourself (yes, that matters too!)

By outsourcing your bookkeeping, you reclaim that time and energy. Many of my clients report feeling like a weight has been lifted off their shoulders once they hand over their financial management to our team.

2. You're Making Costly Tax and Financial Mistakes

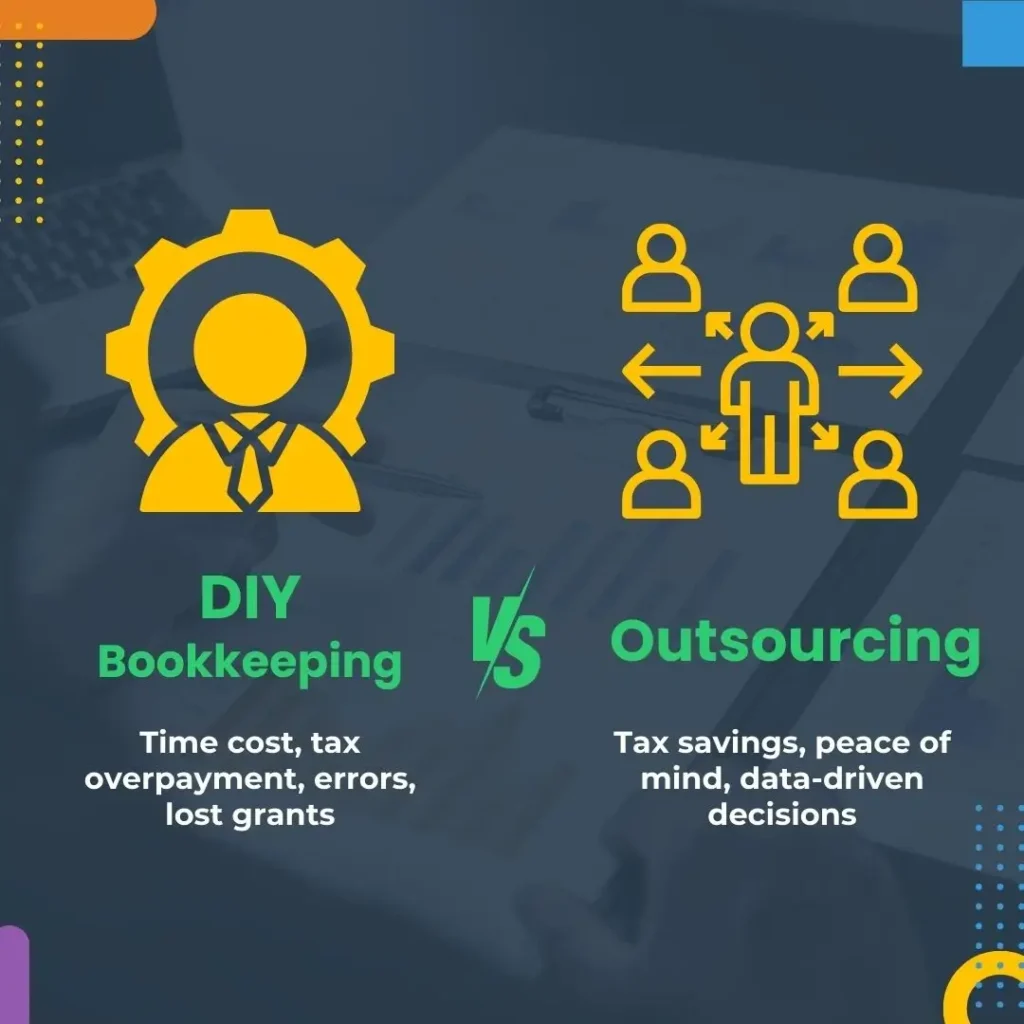

Look, I get it. DIY bookkeeping seems like a way to save money. But trust me, my friends, it often ends up costing you far more in the long run.

If you’ve been handling your own books, there’s a good chance you’re missing out on valuable tax deductions specific to childcare businesses. These might include:

- Space-to-time ratios for home-based providers

- Depreciation on playground equipment and classroom furniture

- Food program deductions

- Professional development expenses

- Special childcare industry credits

The average childcare provider we work with saves $5,000-$15,000 annually in tax deductions they were previously missing.

I recently worked with Chavette, who owns a growing childcare center. For years, she had been using a spreadsheet system to track her finances.

When she came to me, she had received a large and unexpected tax bill. Her spreadsheet method didn’t allow her to make accurate tax estimations throughout the year, leading to insufficient tax payments and a hefty year-end bill.

In another case, our client was advised by her former tax professional to buy two new buses and a car just to offset grant funding. This advisor suggested that she spend around $150,000 to save $48,000 in taxes (she was in a 32% tax bracket). This would have resulted in an unnecessary cash outflow of $150,000 that she didn’t need to spend!

Fortunately, she sought a second opinion. When she called us at The Childcare CPA™, we were able to help her identify missed deductions and plan better for the future without making these unnecessary purchases.

Through proper tax planning and identifying legitimate deductions she was already eligible for, our client was able to save significantly without the major capital expenditures her previous advisor had recommended.

The reality is that the childcare industry has unique financial considerations—from grant compliance to special deductions—that general accounting knowledge simply doesn’t cover. Making mistakes in these areas can lead to:

- Overpaying on taxes: Missing childcare-specific deductions can cost you thousands every year.

- Grant compliance issues: Improper tracking can make you ineligible for future funding.

- Cash flow problems: Without accurate, timely financial data, you can’t make informed decisions.

3. Your Business Needs Financial Clarity for Strategic Growth

There’s a point in every childcare business’s growth journey when financial management becomes too complex for a DIY approach.

This typically happens when:

- You’re expanding to multiple locations

- Your revenue exceeds $250,000 annually

- You’re managing government subsidies or multiple funding streams

- You’re planning to apply for a business loan or a line of credit

- You’ve hired more than 10 employees

I recently worked with David, who was eager to open his third childcare facility even though his first two locations were only operating at around 70% capacity. When we sat down to crunch the numbers, it became clear that David was leaving a significant amount of money on the table by not maximizing the enrollment and profitability of his existing centers.

Instead of rushing into expansion, we worked with David to implement a series of targeted initiatives, things like revamping his marketing and enrollment strategies, optimizing his staffing and scheduling, and finding new revenue streams like summer camps and after-school programs.

Within just 12 months, David had boosted the occupancy rates of his first two centers to 90%, and his profit margins had increased by over 25%. Only then did we start exploring expansion options.

At this stage, professional bookkeeping isn’t just a nice-to-have—it’s essential for sustainable growth. Without accurate financial tracking and reporting, you’re essentially flying blind.

The Return on Investment for Professional Bookkeeping

When you work with a childcare financial specialist, you’re not just paying for someone to input numbers—you’re investing in expertise that can transform your business. Here’s what you gain:

- Industry-specific knowledge: Childcare accountants understand tuition tracking, grant management, and tax deductions specific to your business.

- Timely financial insights: Regular financial reports help you make data-driven decisions.

- Peace of mind: No more worrying about compliance issues or tax mistakes.

- Strategic financial planning: Beyond just tracking what happened, professional support helps you plan for future growth.

Stop Struggling with Spreadsheets: It's Time to Level Up Your Childcare Business

Here’s the bottom line: Outsourcing your bookkeeping to a specialist isn’t an expense—it’s an investment in your business’s growth and your sanity.

If you’re spending hours each week on bookkeeping, missing out on tax deductions, or making decisions without clear financial data, it’s time to consider bringing in the professionals.

Your focus should be on what you do best—providing exceptional care and education to the children in your community, not on struggling with QuickBooks.

Ready to gain financial clarity and keep more of your hard-earned money? At The Childcare CPA™, we specialize in helping childcare providers build profitable, sustainable businesses through expert financial management.

Book a call with our team today and let’s talk about how we can transform your financial future.

- Join Our Free Facebook Community!

Want exclusive financial tips, free training, and support from other childcare providers? Join our Facebook group, “Childcare Profit Strategies,” where we share expert strategies to help you save money and grow your business!