Running a childcare business is a labor of love, am I right? But when it comes to managing finances, it can feel about as exciting as watching paint dry.

Are you drowning in receipts come tax time? Worried that you’re leaving money on the table with missed deductions? Not sure how to make heads or tails of your cash flow?

My friend, these are all flashing neon signs that it’s time to call in reinforcements – and by reinforcements, I mean a specialized accountant who understands the unique financial landscape of daycare and childcare businesses.

Bringing a childcare-focused financial expert into your corner can be the difference between barely scraping by and absolutely crushing your profitability goals.

So let’s jump into when you know it’s time to take the plunge, and how finding the right financial partner can transform your childcare empire.

Want to get right to it? Click here to schedule your free consult with the team at The Childcare CPA™ today!

Why Every Childcare Business Needs a Specialized Accountant in Their Corner

Think of your childcare finances like maintaining a healthy, thriving classroom. Without the right structure, systems, and planning in place, things can spiral into chaos quickly:

- Missed tax write-offs? That’s thousands of your hard-earned dollars flying out the window.

- Messy books? Kiss those juicy grants and loan opportunities goodbye.

- No handle on your cash flow? Good luck expanding to that second location you’ve been dreaming about.

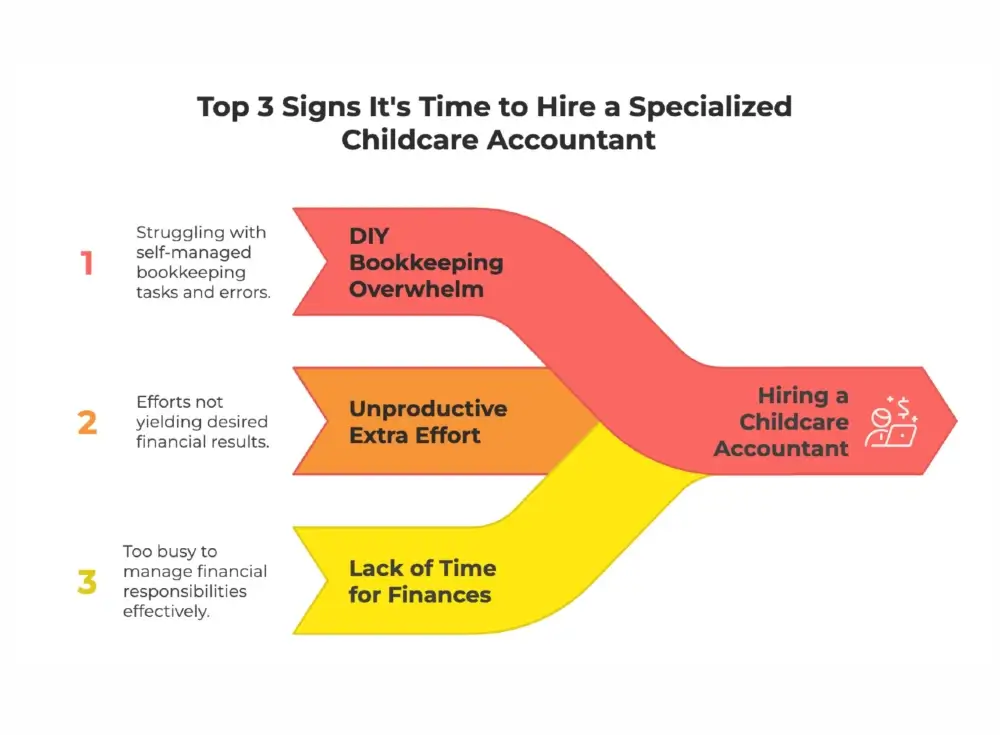

The Top 3 Signs It's Time to Hire a Childcare Accountant

Sign #1: You're Drowning in DIY Bookkeeping

Oh, I know the trap well. You figure you’ll save a few bucks by handling the books yourself. But before you know it, it’s April 14th and you’re knee-deep in a shoebox of receipts, praying to the tax gods that you didn’t miss anything major.

Sound familiar? Then it’s time to call in the pros. A childcare accountant will:

- Ensure you’re claiming every single deduction and credit you’re entitled to (and trust me, there are dozens specific to the childcare industry)

- Keep your books clean and audit-ready so you can focus on what you do best—providing exceptional care to the children in your center

- Develop a customized tax strategy to keep more of your money where it belongs – in your pocket.

Sign #2: Your "Extra Effort" Isn't Paying Off

I see you over there, burning the midnight oil, trying to make QuickBooks work for your childcare business. But despite your best efforts, something just isn’t clicking.

- You’re still handing over way too much cash to Uncle Sam every year

- Your financial records are scattered, making grant writing and loan applications a nightmare

- You’re hustling hard, but your bottom line just won’t budge.

If this is your reality, you need a childcare accounting specialist, like, yesterday. Trust me, having an expert in your corner who knows the childcare industry inside and out is game-changing.

Sign #3: You're Too Busy to Deal with the Numbers

Let’s be real – you’ve got your hands full wrangling little ones, managing staff, and keeping parents happy. Crunching numbers and analyzing cash flow reports? There’s simply not enough time in the day.

But here’s the problem:

- When bookkeeping takes a backseat, you’re essentially flying blind financially

- Without ongoing tax planning, you’re destined to overpay every April

- Making major financial decisions on the fly is a recipe for disaster

Bring in a childcare accountant, and suddenly you’ll have a trusted partner handling all the financial nitty-gritty, so you can stay laser-focused on building the childcare business of your dreams.

How to Find Your Perfect Childcare Accountant Match

Alright, childcare mavericks, listen up! Not all accountants are created equal, especially when it comes to navigating the unique world of childcare finances. You need a number-crunching partner who knows our industry inside and out.

They've Got Mad Skills in Childcare Tax Magic

Your dream accountant should be a total pro at optimizing childcare taxes (legally, of course). Look for a financial wizard who:

- Lives and breathes childcare tax deductions and compliance

- Can track and report your grant funds meticulously

- Has a track record of helping childcare businesses like yours grow and thrive

They Offer Customized Support, Not Cookie-Cutter Nonsense

Every childcare business is unique, just like every child in your care. So why settle for a one-size-fits-all approach to your finances? Find yourself an accounting ally who offers:

- Bookkeeping services tailored to childcare operations

- A financial strategy that aligns with your specific growth goals

- Tax prep and planning that maximizes industry-specific deductions

They've Got the Street Cred to Back It Up

You wouldn’t trust just anyone with the precious children in your care, right? The same goes for your business finances. A legitimate childcare accountant should have:

- Testimonials from other childcare business owners

- Case studies that demonstrate real results

- A reputation for being both knowledgeable and responsive

See How The Childcare CPA™ Has Helped Real Childcare Centers Reach New Heights

At The Childcare CPA™, our only goal is to help childcare businesses like yours save money, grow sustainably, and make an even bigger impact on the families you serve.

But don’t just take my word for it – check out these game-changing results we’ve delivered for our amazing clients.

Case Study #1: Slashing Tax Bills through Strategic Entity Selection

When we met Michelle, she owned Happy Days, LLC, a Single-Member LLC based in Florida. Her business was generating a net profit of $100,000 annually, but she was filing as a Sole Proprietorship on Schedule C of her Form 1040, which wasn’t optimal for her tax situation.

Our Solution: After consulting with Michelle, we elected to restructure her business as an S-Corporation. This strategic move completely transformed her tax obligations.

The Results:

- $8,685 in tax savings in the first year alone

- Reduced her total tax liability from $23,357 to just $14,672.50

- Created a structure that continues to save her money year after year

As a sole proprietor, Michelle was paying both income tax ($9,228) and hefty self-employment taxes ($14,129). By paying herself a reasonable salary of $45,000 and taking the rest as shareholder distributions, we eliminated her self-employment tax burden on a significant portion of her income.

“This restructuring allowed me to reinvest more money back into my childcare center instead of handing it over to the IRS,” shares Michelle. “I only wish I’d done it sooner!”

Case Study #2: Turning Tax Chaos Into Streamlined Success

When Michael first came to us, he was one stressed-out childcare owner. His jumbled LLC structure had him overpaying on self-employment taxes by $18,000! Even though he was paying himself on payroll, he was missing out on major S-Corp benefits.

Our Solution: We gave Michael’s entity structure a total overhaul, converting his LLC to an S-Corporation. We also implemented an Accountable Plan to maximize his home office deductions.

The Results:

- Whopping 80% tax savings – from a $30,000 tax bill down to just $6k

- Thousands in ongoing yearly tax savings

- Clean books and a clear tax strategy for smooth sailing ahead

“I thought I was doing everything right until The Childcare CPA cut my tax bill by 80%. I’m still blown away!” – Michael

Case Study #3: Maximizing Home-Based Deductions for Serious Tax Relief

When Sarah first came to us, she was running her childcare business from an addition built onto her house. She had been using the IRS’s Simplified Method for home office deduction, which capped her at a mere $1,500 deduction. Her previous accountant had advised this “safer” route to avoid potential IRS scrutiny.

Our Solution: After reviewing Sarah’s situation, we recognized she was leaving significant money on the table. We switched her to the actual expense method using IRS Form 8829, which accounts for the true percentage of her home used for business and all associated costs.

The Results:

- Increased her home office deduction from $1,500 to $12,600

- Generated $3,024 in tax savings (at her 24% tax rate)

- Delivered nearly 10x the tax benefit compared to her previous approach

- Created enough savings for Sarah to finally take a well-deserved vacation

Sarah’s rent was $3,000 monthly ($36,000 annually), and her utilities added another $1,200 monthly ($14,400 annually). With 25% of her home dedicated exclusively to business use, she could legitimately claim $12,600 in deductions instead of the $1,500 cap from the simplified method.

“I’d been missing out on thousands in deductions for years because I was afraid of triggering an audit,” Sarah told us. “Now I understand that with proper documentation, I can confidently claim every deduction I’m legally entitled to.”

What to Expect When You Work With a Childcare Accounting Specialist

By now, I hope you’re fired up about the transformative power of having a childcare accounting pro in your corner. But what exactly can you expect when you take the plunge?

A Custom-Fit Financial Roadmap

No two childcare centers are alike – so your financial plan shouldn’t be one-size-fits-all either. When you partner with the right accountant, you’ll get:

- An in-depth analysis of where your money is really going (and where you can optimize)

- A tailor-made tax and growth strategy designed for your unique business model

- Easy-to-follow systems and processes that simplify your finances at every turn

Guidance and Support at Every Step

The best childcare accountants understand that finances aren’t just a once-a-year tax thing – it’s an ongoing process of planning, optimizing, and adjusting as your business evolves. Expect your accounting partner to:

- Be there to answer questions and offer advice year-round

- Adapt your financial strategies as your childcare center grows and changes

- Keep you 100% compliant and prepared for anything the IRS throws your way

Common Misconceptions About Hiring an Accountant Specialized in Daycare or Childcare Business

“I Can Just Do It Myself”

DIY bookkeeping and tax filing might seem cost-effective, but mistakes can lead to:

- Overpaying thousands in taxes.

- IRS penalties for incorrect filings.

- Disorganized finances that prevent business growth.

“It’s Too Expensive”

The right financial expert should save you more money than they cost by:

- Maximizing tax deductions and minimizing liabilities.

- Helping you budget effectively to grow profits.

- Preventing costly IRS mistakes.

“I Only Need Help at Tax Time”

Waiting until tax season is too late! A year-round financial strategy ensures:

- You’re always prepared for tax filing.

- Your cash flow is optimized for business growth.

- You can take advantage of deductions & credits proactively.

Ready to Take the Next Step?

So, ready to wave goodbye to financial stress and hello to bigger profits and a brighter future?

Schedule a Free Financial Consultation Today!

Let’s create a customized plan to help you reduce taxes, get organized, and grow profitably. Trust me, your future self (and your bank account) will thank you.

- Join Our Free Facebook Community!

Want exclusive financial tips, free training, and support from other childcare providers? Join our Facebook group, “Childcare Profit Strategies,” where we share expert strategies to help you save money and grow your business!