Hey, Childcare CEOs, let’s be real—managing a childcare business is hard work. Between payroll, compliance, and tax codes that seem to change by the minute, staying on top of your finances can feel like a full-time job (on top of the million other things you’re already doing). And the truth is, a general accountant just won’t cut it.

You need someone who speaks fluent childcare finance—someone who can save you money, protect your business, and set you up for long-term success. But how do you know if you’re hiring the right person?

Let me break it down for you—these are the non-negotiable traits of a rockstar childcare accountant, because this decision isn’t just about taxes; it’s about the future of your business.

The wrong accountant could be draining your profits—let’s put an end to that. At The Childcare CPA™, we specialize in cutting your tax bill and boosting your bottom line. Ready to stop overpaying? Schedule a call today!

1. They Know Childcare Tax Deductions Like the Back of Their Hand

Here’s a scary fact—nearly 60% of childcare businesses miss out on valuable tax deductions every year, leaving thousands of dollars on the table. A specialist in the childcare industry will find and claim every deduction possible, including:

- Depreciation on your playground equipment, learning materials, and facility upgrades.

- The Work Opportunity Tax Credit (WOTC) if you’re hiring employees from targeted groups.

- Home office deductions (yes, even if you run an in-home daycare, you’ve got tax breaks waiting for you!).

I once met a new client who was advised by her former tax professional to buy two new buses and a car to offset grant funding.

This tax advisor suggested that she should spend around $150,000 to save $48,000 in taxes (she was in a 32% tax bracket). This would have resulted in a cash outflow of $150,000 that she didn’t need to spend.

Luckily, she sought a second opinion from us. We were able to help her identify missed deductions and plan better for the future.

This highlights the importance of making informed decisions and not purchasing unnecessary items solely for tax benefits. Always consider the overall financial impact and seek a second opinion if unsure.

If you’re wondering, “How much should I expect to pay for a childcare accountant?”—the answer depends on the level of service you need. But let me tell you this: the right accountant will save you far more than they cost. If your accountant isn’t obsessed with finding you savings, you’re overpaying on taxes, and that needs to stop.

2. They Know Payroll (and How to Keep the IRS Off Your Back)

Payroll is one of the biggest expenses for childcare centers, and doing it wrong can cost you thousands in penalties. A great accountant will help you:

- Properly classify workers (W-2 vs. 1099—yes, this matters A LOT).

- Optimize payroll tax withholdings to avoid overpaying.

- Implement tax-efficient payroll strategies, like paying yourself the right way through an S-Corporation.

Common Payroll Pitfalls & How a Childcare CPA Can Help

- Misclassifying employees as 1099 contractors: The IRS issues hefty penalties for misclassification, and a seasoned CPA ensures your workers are properly categorized.

- Overpaying payroll taxes: With strategic planning, your accountant can help structure wages and benefits to minimize your tax burden while staying compliant.

- Not leveraging pre-tax benefits: A childcare CPA can help you implement retirement plans, health benefits, and tuition assistance programs to reduce taxable income.

One of the biggest tax mistakes childcare owners make? Not planning ahead. I see so many businesses that don’t check in with their accountant until tax season—by then, it’s often too late to implement powerful tax-saving strategies.

If your accountant isn’t keeping more of your money in your pocket, you need to rethink who you’re working with.

3. They Help You Set Up (or Fix) Your Business Structure

Listen, choosing the right business structure isn’t just a formality—it’s the difference between paying too much in taxes and keeping thousands of dollars for yourself. The best childcare accountants will:

- Analyze your current structure and tell you if an LLC, S-Corp, or something else makes the most sense.

- Guide you through entity optimization so you aren’t overpaying in self-employment taxes.

- Help you plan for future growth (because your business isn’t staying small forever!).

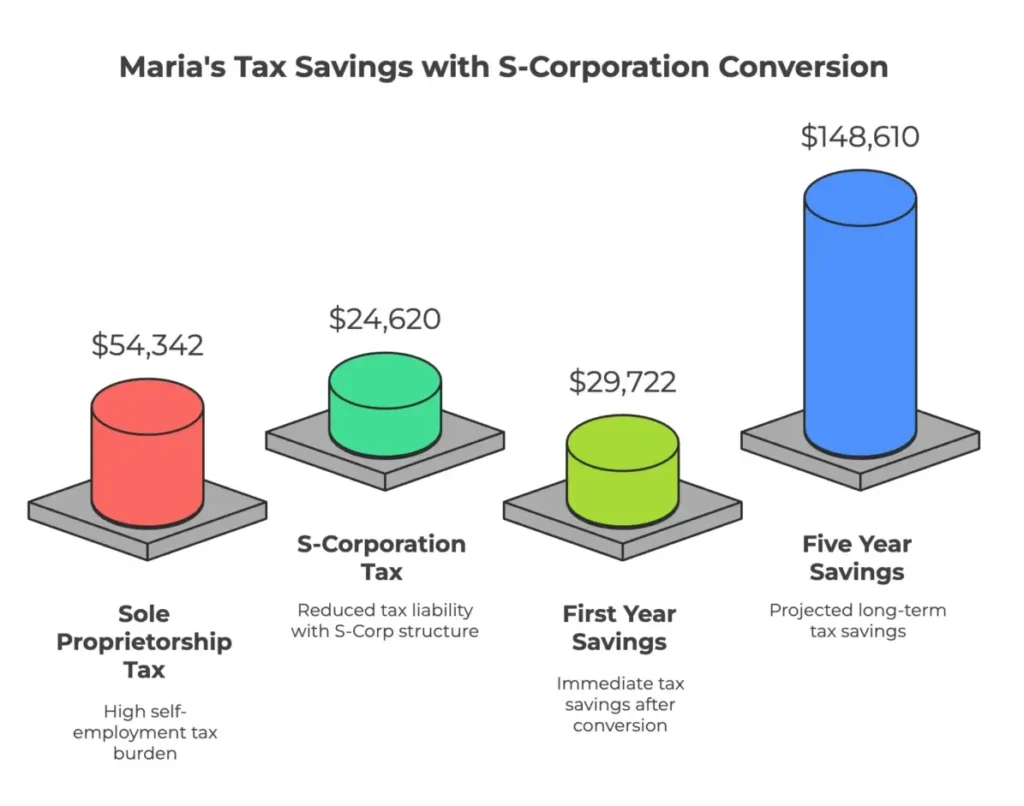

I had a client named Maria who was operating as a sole proprietor and bringing in $200,000 a year in profit (after expenses . Because of this, she was paying self-employment tax on every single dollar of that profit, resulting in a tax bill of $54,342, which included penalties for not making estimated tax payments.

After we analyzed her business structure, we determined it wasn’t ideal for her profit level. We converted her to an S-Corporation and established reasonable compensation for her. As a result, Maria was legally paying $0 in self-employment tax on the full $200,000 profit.

Following the conversion, Maria took a distribution of $120,000 out of her business. Her tax savings in the first year amounted to $29,722, as her tax bill went down from $54,342 to $24,6202 . We projected that as long as things remained consistent, this one strategy could save Maria $148,610 over the next five years.

If you’re asking, “How do I know if my accountant is missing deductions?”—the answer is simple. If they’re not asking about your payroll, entity structure, and industry-specific tax credits, they’re leaving money on the table. And that’s money that should be in your pocket.

4. They Have a Track Record of Helping Childcare Businesses Thrive

An accountant who specializes in childcare doesn’t just do taxes—they help their clients scale, grow, and WIN. The right accountant will:

- Help you qualify for funding and ensure your financials look solid for loans or grants.

- Develop a tax strategy that supports your expansion.

- Guide you in making informed financial decisions, not just reacting at tax time.

Case Study: How the Right CPA Helped Emilia's Childcare Business Expand

Emilia wanted to expand her successful childcare center by purchasing a commercial building for her second location. She wasn’t sure how to finance this growth while maintaining a healthy cash flow. After working with us, we helped her:

- Secure a business loan with a 20% down payment, allowing her to purchase the building while preserving significant cash reserves.

- Structure her financing to maximize tax deductions on loan interest, which will more than offset her monthly payments over time.

- Free up her existing cash for reinvestment in other critical aspects of her business rather than tying it all up in real estate

Today, Emilia’s second location is thriving, and the tax deductions from her commercial mortgage have substantially reduced her overall tax burden. By making strategic financial decisions with expert guidance, she’s positioned her childcare empire for sustainable, long-term growth.

If you’re tired of guessing what you owe or feeling shocked by a surprise tax bill, it’s time to work with an accountant who keeps you informed and prepared.

5. They Work With You Year-Round (Not Just at Tax Time)

A tax preparer files your return and disappears. A true childcare financial strategist works with you ALL YEAR LONG to make sure you’re maximizing profits and staying ahead of tax liabilities. This means:

- Quarterly tax planning sessions.

- Proactive strategy updates when tax laws change.

- Ongoing cash flow and expense planning so you always know where you stand.

Remember, there’s a difference between profit and bank balance. It is possible to finish the year with a low bank balance and a high tax bill. That’s why ongoing planning matters.

Imagine a childcare center that finishes the year with a net profit of $50,000. This figure indicates the overall financial performance, showing that revenue exceeded expenses by $50,000.

However, the bank balance at year-end is only $10,000. How could this discrepancy occur?

The reality is that profit is calculated as revenue less expenses. But there are other cash flows that come out of your business that aren’t expenses, such as credit card payments, loan payments, personal draws and distributions, or asset purchases that get written off through depreciation over time rather than all at once.

Without regular check-ins, these differences can lead to costly surprises.

6. They Help You Stay Compliant and Avoid Costly Penalties

Childcare businesses face strict regulations and financial compliance requirements, and failing to meet them can result in hefty fines or even business closure.

A great childcare accountant does more than just manage taxes—they make sure you’re following the financial rules set by state and federal agencies.

How I Help You Stay Compliant:

- Licensing & Tax Filings: Ensuring your state and local business licenses are in good standing and that you’re meeting all tax filing deadlines.

- Payroll Compliance: Making sure your payroll system follows state labor laws and that all employment tax filings are accurate.

- Grant & Funding Compliance: If you receive government grants or any other form of external funding, I’ll ensure the funds are accounted for properly to avoid audit issues.

- Record-Keeping Best Practices: Keeping detailed financial records is not just good business—it’s the best defense if you ever get audited. I’ll guide you in what to track, how to store records, and what reports to have ready at all times.

If you’ve ever wondered, “How do I avoid financial mistakes that could cost me my business?”—this is where having the right accountant makes all the difference.

Financial compliance isn’t just about avoiding penalties—it’s about protecting the business you’ve worked so hard to build.

7. They Make Taxes (Almost) Fun to Understand

Okay, maybe “fun” is a stretch—but a great accountant explains your finances in a way that makes sense. They don’t just throw tax jargon at you; they teach you how to play the game so you can win.

I know some of you might be thinking, “But Shanita, I’m not a numbers person!” Well, guess what? Most of my most successful clients weren’t either. But they learned enough to make informed decisions, and that’s the goal—not turning you into an accountant but empowering you to be the CEO your childcare business deserves.

When evaluating a potential accountant, ask yourself:

- Are they breaking things down in plain English?

- Are they available when you have questions?

- Do they care about your business like it’s their own?

If your accountant doesn’t feel like a true partner, it’s time to upgrade.

Want an Accountant Who’s Built for Childcare Businesses?

At The Childcare CPA™, we specialize in helping childcare business owners maximize their profits, legally pay less in taxes, and build financial strategies that last.

If you’re tired of accountants who don’t get the childcare industry or want to know how much money you’ve been overpaying, let’s talk.

Schedule a free consultation today because your business deserves an accountant who actually understands it.

- Join Our Free Facebook Community!

Want exclusive financial tips, free training, and support from other childcare providers? Join our Facebook group, “Childcare Profit Strategies,” where we share expert strategies to help you save money and grow your business!