When I tell people I’m The Childcare CPA™, I usually get one of two reactions. Either they light up because they’ve been desperately searching for someone who understands their specific financial challenges, or they give me a blank stare and ask, “Is that really different from any other CPA?”

Trust me, my friends, it’s different. Very different. The childcare industry comes with its own unique set of financial complexities—from managing tuition tracking and enrollment fluctuations to navigating grant compliance and industry-specific tax deductions.

In my experience working with hundreds of childcare centers over the years, I’ve found that centers working with industry-specialized accountants like us typically save between $8,000-$15,000 more in taxes annually compared to those using general CPAs.

These savings come from our deep understanding of childcare-specific deductions, credits, and strategies that general accountants often miss.

Many childcare business owners assume that any accountant can handle their books and taxes. After all, numbers are numbers, right? Wrong.

That’s like saying any doctor can perform heart surgery because they all went to medical school. The reality is that understanding the financial nuances of the childcare industry requires specialized knowledge that most general accountants simply don’t have.

I’ve spent years developing financial systems designed explicitly for childcare businesses. My team and I have helped hundreds of providers across the country transform their financial chaos into clarity, slash their tax bills, and build profitable, sustainable businesses.

Ready to transform your financial stress into financial success? Book a free strategy call with me today!

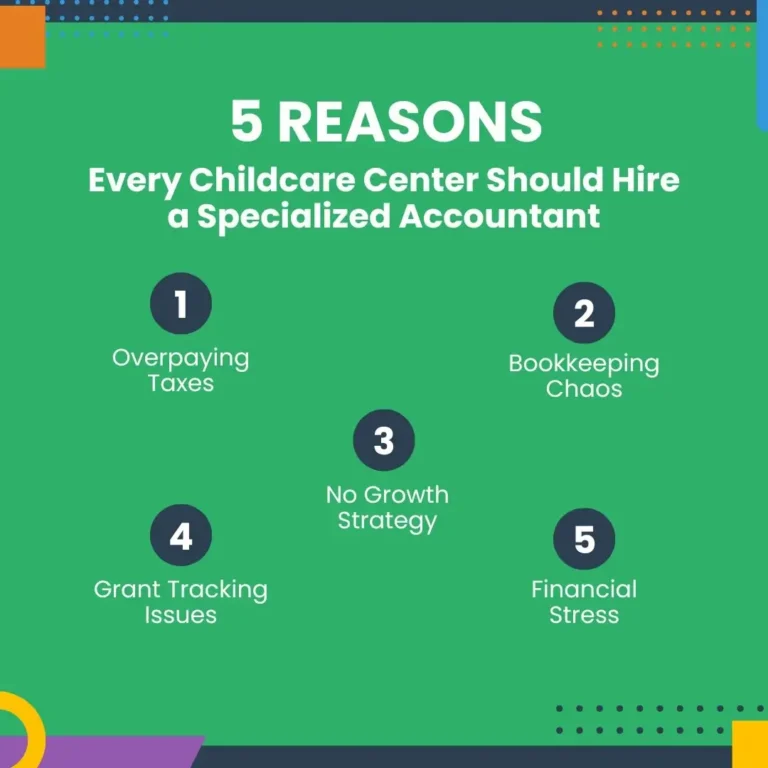

Reason #1: You're Overpaying on Taxes (By Thousands!)

Most childcare owners are paying way more in taxes than they legally need to. And I’m not talking about a few hundred dollars here and there.

I’m talking about thousands of dollars that could be reinvested into your business or your personal wealth.

Here’s why this happens:

- Many childcare-specific deductions are completely overlooked by general accountants

- Without proper entity structure optimization, you’re likely paying excessive self-employment taxes

- Most providers don’t have strategic tax planning in place to minimize their liability

- Grant management is often mishandled, creating unnecessary tax burdens

Take Michael’s story. When he first came to me, he owed $36,000 in taxes. After reviewing his situation, we discovered that $18,000 of that was unnecessarily being paid in self-employment taxes!

By converting his business to an S-Corporation and implementing proper tax strategies, we reduced his tax bill from $30,000 to just $6,000—an 80% savings.

Had Michael found us earlier in the year, we could have implemented strategies to reduce his bill to zero.

With a childcare-specialized accountant, you get someone who knows exactly which deductions you qualify for and how to strategically structure your finances to keep more of your hard-earned money right where it belongs—in your pocket.

Reason #2: Your Bookkeeping Is a Hot Mess (Making Growth Impossible)

If I had a dollar for every childcare owner who came to me with a shoebox full of receipts or a chaotic QuickBooks file, I’d be retired on a beach somewhere!

Messy or non-existent bookkeeping is actively preventing your business from growing.

When your financial records are disorganized:

- You can’t qualify for the loans and grants needed to expand

- You have no clear picture of which aspects of your business are profitable

- Making data-driven decisions becomes impossible

- You’re constantly stressed and playing catch-up

Consider Jane, who operated her childcare center using what I call the “Shoebox Accounting System.” On paper, she had a decent bank balance of $32,000, which made her think her business was doing well.

However, when we analyzed her actual financial position, we discovered that her true profit was only $10,000. The difference? Money from loans, personal funds she’d injected, and other non-income sources that were masking her true financial picture.

Jane was making crucial business decisions based on her bank balance rather than her actual profitability, leading her to set aside far more for estimated tax payments than necessary, money that could have been used to pay down loans and reduce interest expenses.

A specialized childcare accountant doesn’t just record transactions—we create financial systems that provide clarity and serve as the foundation for sustainable growth.

Reason #3: You Don't Have a Strategic Growth Plan (Just Hopes and Dreams)

I’m all for big dreams and ambitious goals. But without a solid financial roadmap, those dreams are just wishful thinking.

Most childcare owners I meet want to:

- Open additional locations

- Increase enrollment

- Offer new programs

- Pay themselves a better salary

- Eventually sell their business for maximum value

But they have absolutely no idea how to get from where they are to where they want to be. They’re operating on hope rather than strategy.

Look at David’s story. He was eager to open his third childcare facility, but his first two locations were only operating at around 70% capacity.

Instead of rushing into expansion, we worked with David to implement a series of targeted initiatives—revamping his marketing and enrollment strategies, optimizing staffing and scheduling, and finding new revenue streams.

Within just 12 months, David had boosted the occupancy rates of his first two centers to 90%, and his profit margins increased by over 25%.

Only then did we start exploring expansion options. By taking the time to truly optimize his existing operations, David secured significantly more favorable financing terms for his expansion. The result? His third and fourth locations were profitable within the first year of opening.

Reason #4: Your Grant Money Is Improperly Tracked (Risking Serious Consequences)

In recent years, grant funding has become a significant part of the childcare landscape. But these funds come with strict tracking and reporting requirements that, if not properly followed, can lead to some serious problems.

When grant funds aren’t properly tracked:

- You risk having to repay the money (even if you’ve already spent it)

- You might become ineligible for future funding

- Your financial statements become inaccurate

- Tax implications can be mishandled, creating additional liabilities

Tamika, who owned five childcare locations all within a five-minute drive of each other, struggled with this exact issue. Without proper financial tracking, she had no clear understanding of the profitability of each location, only knowing that her business was profitable overall.

She guessed her first location was the most profitable due to its size and enrollment numbers. However, after implementing location-specific financial tracking, we discovered her first location was actually draining resources from the other profitable centers!

This insight allowed Tamika to reassign families and staff from the two non-profitable locations and repurpose the space for other business ventures, significantly increasing her overall profitability.

Childcare-specialized accountants understand the nuances of different grant programs and can help you establish proper tracking systems from day one. We ensure that every dollar is accounted for and that you have the documentation needed for smooth reporting and compliance.

Reason #5: You're Drowning in Financial Stress (Instead of Focusing on Kids)

You didn’t get into childcare to spend your evenings and weekends stressing about finances. You got into this business because you have a passion for early childhood education and making a difference in children’s lives.

Yet here you are:

- Lying awake at night, worrying about cash flow

- Scrambling to cover payroll when enrollment dips

- Dreading tax season like it’s a root canal

- Feeling completely overwhelmed by grant reporting requirements

This financial stress isn’t just bad for your well-being—it’s impacting the quality of care you can provide. When you’re constantly worried about money, you can’t be fully present for the children and families who need you.

Take Maria’s story. She had been running her childcare business for years, pouring her heart into early childhood education, yet she was drowning in financial stress.

Every year, she found herself paying a staggering $54,342 in taxes, with most of that coming from self-employment tax. She was essentially working to pay the IRS, not her own family or business.

We helped her transition from constantly scrambling to cover tax bills to strategically managing her business’s financial health. By restructuring her business to an S-corp and establishing a strategic approach to compensation, Maria saved $29,722 in taxes that first year, with projections of saving $148,610 over the next five years.

More importantly, she reclaimed her peace of mind, allowing her to focus on what really matters: the children and families who depend on her.

Stop Leaving Money on the Table: Your Next Steps Toward Financial Freedom

Many childcare owners try DIY solutions or work with general bookkeepers and tax preparers before seeking specialized help. While this might seem cost-effective in the short term, it often leads to missed opportunities, compliance issues, and significant overpayment in taxes.

Finding the right financial partner for your childcare business is one of the most important decisions you’ll make as an owner. You need someone who truly understands the unique challenges and opportunities in your industry, not just someone who knows how to balance books or file tax returns.

It’s time to take control of your childcare business’s financial future. You didn’t cut corners when creating your educational programs or hiring your teaching staff—don’t cut corners on your financial management either. Your business deserves specialized expertise that will help it not just survive, but truly thrive.

Ready to transform your childcare business finances? Let’s talk about how my team and I can help you pay less in taxes, gain financial clarity, and build a more profitable childcare business—without the stress, confusion, or missed opportunities.

- Join Our Free Facebook Community!

Want exclusive financial tips, free training, and support from other childcare providers? Join our Facebook group, “Childcare Profit Strategies,” where we share expert strategies to help you save money and grow your business!