About Us

Welcome to The Childcare CPA

At The Childcare CPA™, we are more than just an accounting firm; we are the trusted financial partners to childcare businesses across the nation. Led by Shanita Jones, CPA, our firm is dedicated to empowering childcare owners with the financial insights and strategies needed to thrive in a competitive landscape.

Our Mission

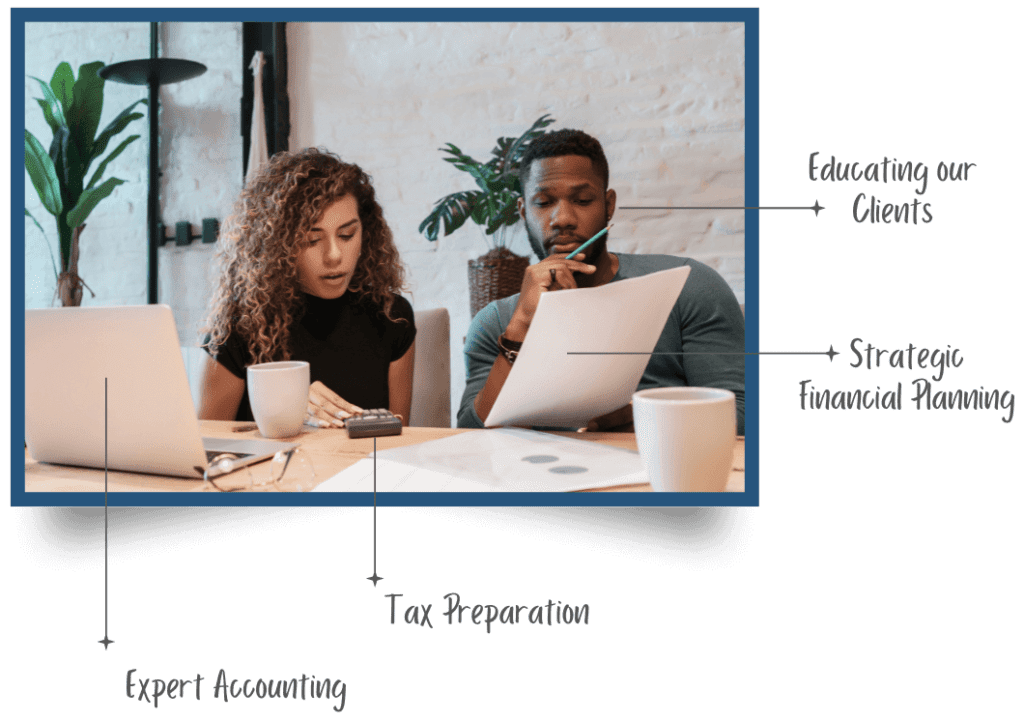

Our mission is to elevate childcare businesses by providing expert accounting, tax preparation, and strategic financial planning services. We believe in the power of education and empowerment, ensuring that our clients not only understand their financial standing but also how to leverage it for growth and stability.

Our Journey

Shanita Jones, the heart and soul behind The Childcare CPA™, set off on this journey with a clear vision: to demystify financial management for childcare business owners. Drawing from years of experience and a deep understanding of the childcare industry’s unique challenges, Shanita and her team have crafted a suite of services designed to address the specific needs of childcare businesses.

Why Choose Us?

Industry Specialization

We focus exclusively on childcare businesses, providing tailored advice and solutions.

Holistic Approach

Our services encompass everything from tax preparation to strategic financial planning, ensuring a comprehensive approach to your business's finances.

Empowerment Through Education

We believe in educating our clients, providing them with the knowledge and tools to make informed financial decisions.

Customized Solutions

Understanding that no two childcare businesses are the same, we offer personalized services to meet your specific needs.

Our Core Values

Integrity:

We uphold the highest standards of professionalism and ethical conduct.

Transparency:

Open and honest communication is at the core of all our client relationships.

Innovation:

We continually seek out new ways to provide value to our clients, leveraging the latest technology and best practices.

Empowerment:

Our goal is to empower childcare business owners to take control of their financial future.

FAQ's

Frequently Asked Questions

Can you help my childcare business if I'm located outside of your state?

Absolutely! We are a virtual accounting practice that serves childcare business owners in all 50 states. Our digital tools and platforms allow us to communicate and collaborate with you no matter where you are located.

How does virtual accounting work for childcare centers?

Our virtual accounting services are designed for ease and efficiency.

We use secure cloud-based accounting software and communication tools to manage your books, offer tax advice, and conduct meetings. You’ll have access to your financials anytime, anywhere, and regular meetings with us can be done through video or phone calls.

What accounting software do you use?

We primarily work with QuickBooks Online, given its versatility and accessibility.

However, we are experienced with various accounting software platforms and can work with what you currently use or help you transition to a system that best suits your childcare business’s needs.

How often will we communicate?

Communication frequency depends on the service package you choose, but you can expect unlimited email support with response times ranging from 2 to 4 business days, based on your tier.

Additionally, we schedule regular meetings (monthly, quarterly, or bi-annually) to review your financials and discuss strategies.

What kind of financial reports will I receive?

You’ll receive comprehensive financial reports including, but not limited to, profit and loss statements, balance sheets, and cash flow statements.

The frequency of these reports will depend on your chosen service package.

Can you help me with tax preparation and planning?

Yes, we specialize in tax services for childcare businesses. This includes annual tax estimation, tax preparation for your business and personal taxes (depending on the package), and strategic planning to minimize your tax liabilities.

What is included in your bookkeeping services?

Our bookkeeping services include transaction categorization, reconciliation of accounts, and the preparation of financial statements.

We also offer budgeting, tax estimation checks, and support for any accounting-related queries you have.

How can I get started with your services?

Starting is easy! Schedule a Discovery Call with our team so we can understand your needs and recommend the best service package for you.

From there, we’ll guide you through the onboarding process.

What happens if I decide to disengage from your services?

We strive to provide top-notch service but understand circumstances change.

If you decide to disengage, we’ll assist with the transition. Note that annual contracts not completed may not include a pro-rated tax return but can be purchased separately.

How are additional meetings billed?

Additional meetings beyond those included in your package can be scheduled for an additional fee.

The cost varies by tier, with some packages offering additional meetings at no extra cost.

What happens on the complimentary discovery call or tax talk call?

Our complimentary discovery calls, or Tax Talk calls, provide a valuable opportunity for us to learn more about your childcare business or personal tax needs.

During these calls, we’ll introduce our range of services tailored for childcare accountants, from tax preparation to strategic planning, and determine the best path forward for our potential partnership.

If you require specific advice or support beyond the introductory discussion, we might suggest scheduling a paid consultation for more in-depth assistance.

Does your firm perform audits for childcare centers?

We do not conduct audits. Specializing in childcare taxes and accounting, our focus is on supporting the growth of your childcare business and helping you build generational wealth, rather than performing audits.

However, we’re equipped to assist you in audit preparation and completion, ensuring you’re ready and compliant without performing the audit ourselves.

Do you work with nonprofit childcare centers?

Absolutely! Our experience with nonprofits, especially in the childcare sector, spans grant reporting and budgeting.

We’re adept at helping nonprofit childcare centers remain compliant and secure continued funding, all while fostering growth and sustainability.

Can you prepare my childcare business's taxes if you didn't handle my accounting?

Yes, we can still prepare your tax return even if we haven’t managed your accounting. To ensure a smooth tax filing process for your childcare business, we recommend beginning with a Childcare Tax Readiness Call.

This step helps us verify that all necessary documentation and information are organized and ready for an accurate and beneficial tax filing.

My spouse and I own different types of businesses. Can you assist us?

Many of our clients entrust us with their broader financial needs due to the quality of our service. We’re more than capable of assisting with various types of businesses, provided they align with our expertise.

Our team is comprised of fully degreed accountants experienced in diverse industries beyond childcare, enabling us to offer comprehensive financial guidance and support.

What if I don't have an organized set of books? Can you still prepare my tax return?

Absolutely. If your books are not up to date, our firm offers catch-up and clean-up accounting services. We ensure your financial records are accurate, allowing us to file your tax returns effectively and maximize your deductions and credits.

Starting with a clean slate guarantees the best possible financial outcome for your childcare business.